Contents:

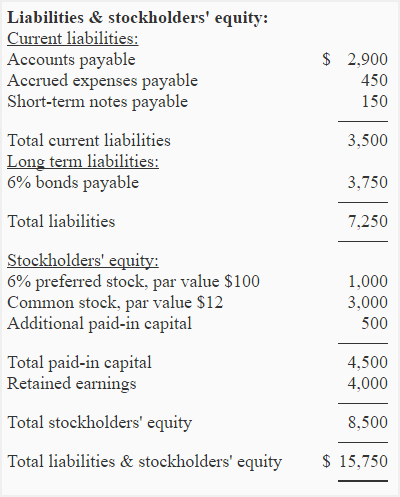

A notes chart of accounts example is similar to accounts payable in that the company owes money and has not yet paid. The balance sheet is a formal presentation of the accounting equation. The three primary components of the balance sheet are assets, liabilities, and stockholders’ equity. Let’s walk through a quick example where a company intends to raise $5 million by issuing debt. To record that transaction, you would credit liabilities in the amount of $5 million. You would then debit assets by $5 million to reflect an increase in cash on the balance sheet .

At this point, Shanti can claim 100 percent of the assets of the business, which right now consist only of the cash. In terms of results, in double-entry accounting both sides of the accounting equation are required to balance out at all times. For example, if your business assets total $200,000, the sum of your liabilities plus the owners’ or stockholders’ equity also equals $200,000. If it doesn’t balance, go back and check for an accounting or data entry error.

You only enter the transactions once rather than show the impact of the transactions on two or more accounts. This refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted. Thus, although the accounting equation formula seems like a one-liner, it contains a lot of meaning and can be explored deeper with complex expense entries. Net LossNet loss or net operating loss refers to the excess of the expenses incurred over the income generated in a given accounting period.

These will affect the accounting equation as follows:

This provides valuable information to creditors or banks that might be considering a loan application or investment in the company. This category includes the value of any investments made in the organisation, whether through the owners or shareholders. Owner’s equity will equal anything left from the assets after all liabilities have been paid.

Net income reported on the income statement flows into the statement of retained earnings. If a business has net income for the period, then this will increase its retained earnings for the period. This means that revenues exceeded expenses for the period, thus increasing retained earnings. If a business has net loss for the period, this decreases retained earnings for the period. This means that the expenses exceeded the revenues for the period, thus decreasing retained earnings. The dividend could be paid with cash or be a distribution of more company stock to current shareholders.

Shanti purchases the laptop with a credit card, and the clerk finalizes the sale. Figure 5 shows the impact of the sale on the accounting equation. Is a debt that a company has incurred with another party, as when it borrows money from a bank or purchases materials from other suppliers. The business is required to make a future payment to satisfy that debt. For accounting purposes, we want to be able to see what the business owns compared with what it owes . For example, if Shanti does not have sufficient cash to pay for the laptop, she may have the electronics store charge her credit card for the purchase.

Barbara is currently a financial writer working with successful B2B businesses, including SaaS companies. She is a former CFO for fast-growing tech companies and has Deloitte audit experience. Barbara has an MBA degree from The University of Texas and an active CPA license.

Accounting equation definition

The accounting equation states that the amount of assets must be equal to liabilities plus shareholder or owner equity. The accounting equation sets the foundation of “double-entry” accounting since it shows a company’s asset purchases and how they were financed (i.e. the off-setting entries). If a company’s assets were hypothetically liquidated (i.e. the difference between assets and liabilities), the remaining value is the shareholders’ equity account. The Accounting Equation is a fundamental principle stating that a company’s assets (i.e. resources) must always be equal to the sum of its liabilities and equity (i.e. funding sources). Share repurchases are called treasury stock if the shares are not retired.

- Expenses are the costs to provide your products or services.

- Total assets will equal the sum of liabilities and total equity.

- She has a combined total of twelve years of experience working in the accounting and finance fields.

- Likewise, distributions to owners are considered “drawing” transactions for sole proprietorships and partnerships but are considered “dividend” transactions for corporations.

In other words, the total amount of all assets will always equal the sum of liabilities and shareholders’ equity. This category includes any obligations the company might have to third parties, such as accounts payable, deferred revenue, or other debts. The two sides of the equation must always add up to equal value. The amount put in by the company owners or the amount that would remain off from the realized assets if all the creditors are paid off is represented by the shareholder’s equity.

Showing You Understand the Accounting Equation on Resumes

For example, inventory is very liquid — the company can quickly sell it for money. Real estate, though, is less liquid — selling for cash is time-consuming and sometimes difficult, depending on the market. The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left side value of the equation will always match the right side value.

This may be difficult to understand where these changes have occurred without revenue recognized individually in this expanded equation. You can find a company’s assets, liabilities, and equity on a few key financial statements, including the balance sheet and the income statement. These financial statements give a quick overview of the company’s financial position. The accounting equation makes sure the balance sheet is balanced, showing that transactions are recorded accurately. The accounting equation can help you see the relationship between your assets, liabilities, and owners’ equity. It ensures that the balance sheet is balanced and helps you detect possible errors in your recordkeeping.

The beautiful thing about https://1investing.in/ and the three-statement models it helps inform is that they create a closed system. What affects the income statement also affects the balance sheet, and any change on the balance sheet must be captured by the cash flow statement. If you understand these relationships, then you will also know how cash moves through a business. The laptop still costs $1,000, but the business has only $100 in cash assets.

Here, every transaction must have at least 2 accounts , with one being debited & the other being credited. Interest PayableInterest Payable is the amount of expense that has been incurred but not yet paid. It is a liability that appears on the company’s balance sheet.

Double entry bookkeeping system

Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. As machinery is bought on credit, liability will increase by $2,000, while machinery or asset will increase by $2,000. Make a trial balance to ensure that debit balances equal credit balances.

- Creating a separate list of the sum of all liabilities on the balance sheet.

- Thus, the accounting equation is an essential step in determining company profitability.

- This transaction would reduce cash by $9,500 and accounts payable by $10,000.

- Service companies do not have goods for sale and would thus not have inventory.

- For example, if a company buys a $1,000 piece of equipment on credit, that $1,000 is an increase in liabilities but also an increase in assets.

In this transaction, with capital being introduced in the business, cash is added, which brings the result of the accounting equation being perfectly balanced. And capital is the money put in by the owners, be it a firm or company (shareholder’s equity). An automated accounting system is designed to use double-entry accounting.

What Is a Balance Sheet? – Money

What Is a Balance Sheet?.

Posted: Wed, 01 Feb 2023 08:00:00 GMT [source]

If you borrow $25,000 from a bank, your assets increase by $25,000. However, because you have to pay the loan back, your liabilities also increase by $25,000. Revenue and owner contributions are the two primary sources that create equity. Because you make purchases with debt or capital, both sides of the equation must equal.

This should be impossible if you are using accounting software, but is entirely possible if you are recording accounting transactions manually. In the latter case, the only way to correct the issue is to review all entries made to date, to find the unbalanced entry. What if you print the balance sheet and the total of all assets do not match the total of all liabilities and shareholders’ equity? There may be one of three underlying causes of this problem, which are noted below. This reduces the cash account and reduces the retained earnings account.

The corporation received $50,000 in cash for services provided to clients. The corporation prepaid the rent for next two months making an advanced payment of $1,800 cash. The corporation paid $300 in cash and reduced what they owe to Office Lux. We want to increase the asset Supplies and increase what we owe with the liability Accounts Payable. The new corporation purchased new asset for $500 but will pay for them later.

Nenhum produto no carrinho.

Nenhum produto no carrinho.